CASE STUDY #3

Food and Beverage Information Project (iFAB)

Stream 2: Emerging Growth Opportunities, Regional Growth Opportunities and Market Reports

iFAB supporting investment and growth in NZ’s Food and Beverage Sectors. A ten year (2011-2021), all-of-government project.

Client

Problem

The project team identified additional information required to support investment in the F&B industries. In particular identifying emerging growth opportunities was a priority.

Solution

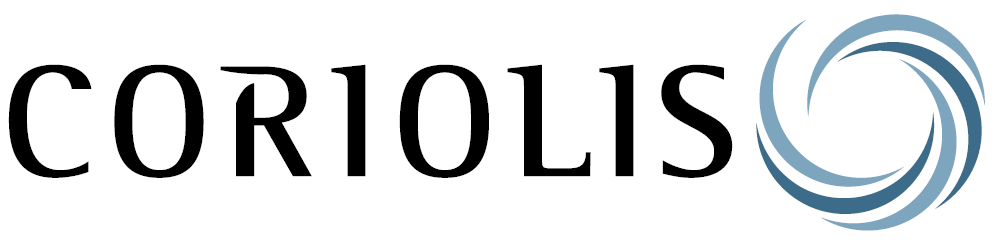

Coriolis produced special topic reports, deep dives into topical subjects (e.g., the Regional Growth Opportunities series) and Market reports. The highlight however is the Emerging Opportunities series (EGO). These reports identify and then profile growth sectors in the New Zealand F&B sectors.

What we did

Stream 2 of the Food and Beverage Information Project (iFAB) extended the project’s focus beyond core sectors to explore what’s next in New Zealand’s food, beverage, and bioeconomy sectors. Coriolis developed a suite of forward-looking reports covering emerging growth categories, regional sector opportunities, and international market dynamics—all designed to spotlight opportunities for investment, innovation, and strategic growth.

1. Emerging Growth Opportunities (EGO)

This series began with a simple question:

What will be New Zealand’s next “wine industry”?

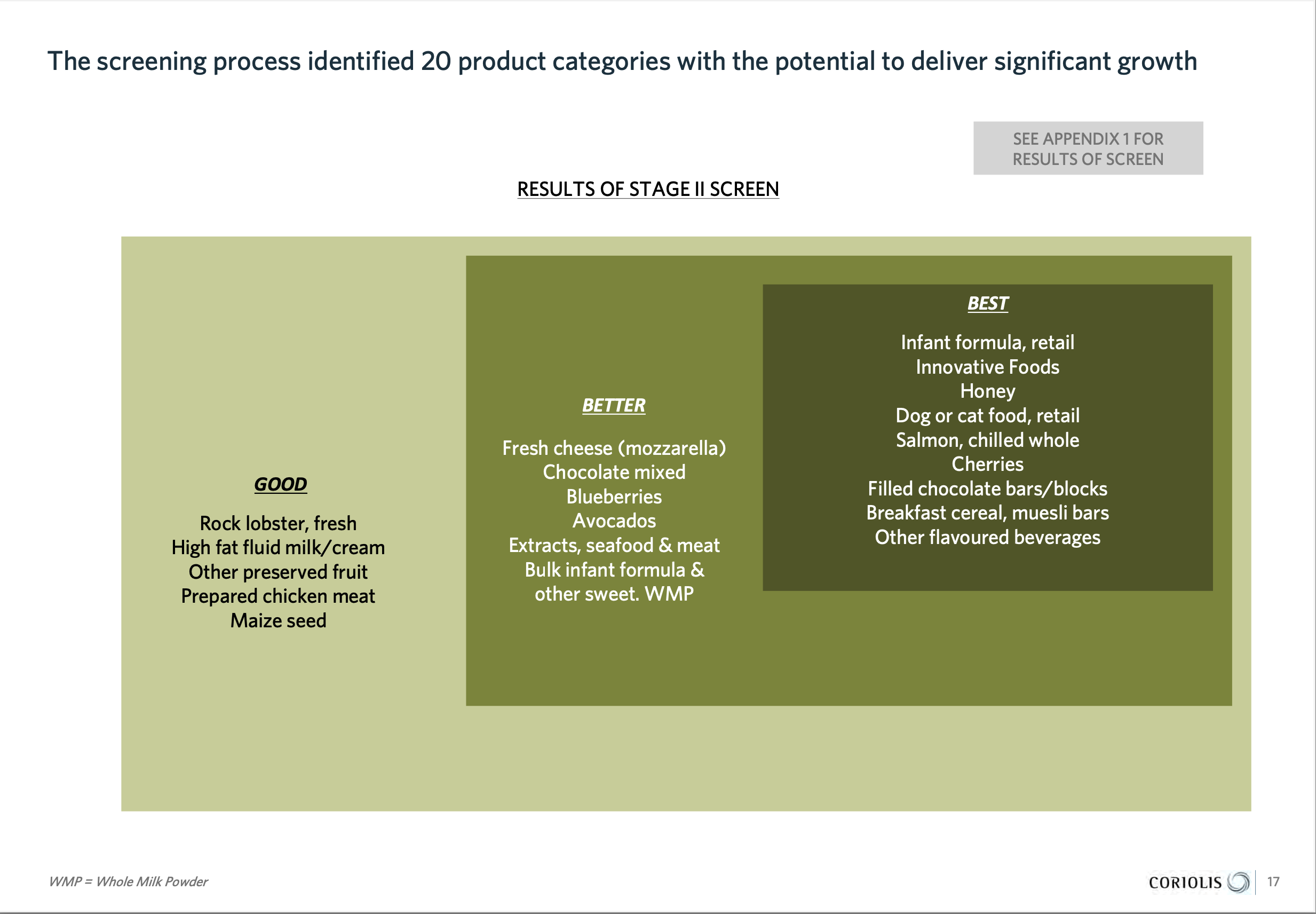

The EGO reports:

Screened hundreds of emerging F&B categories

Conducted deep dives into ten high-potential subsectors, such as:

Honey

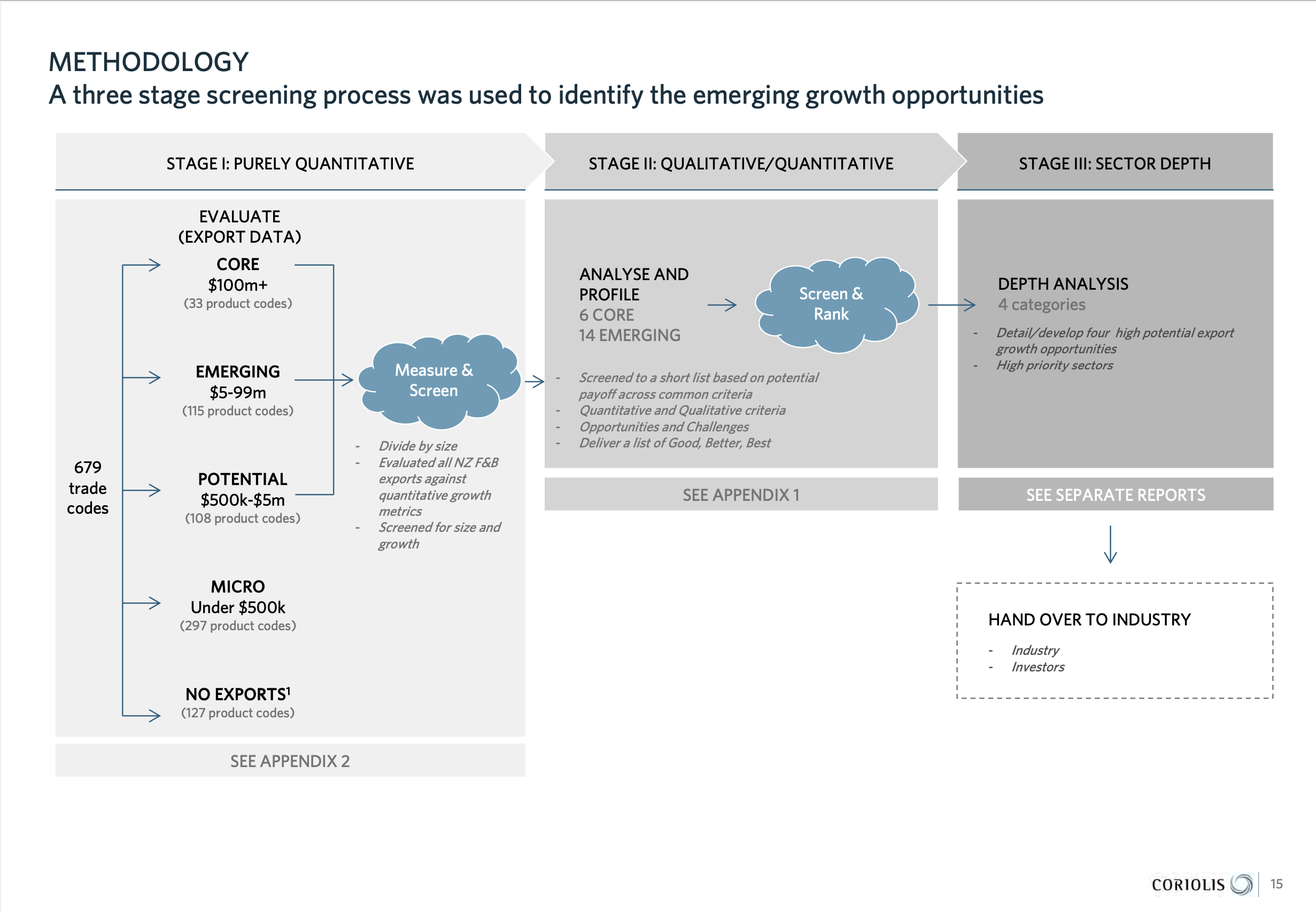

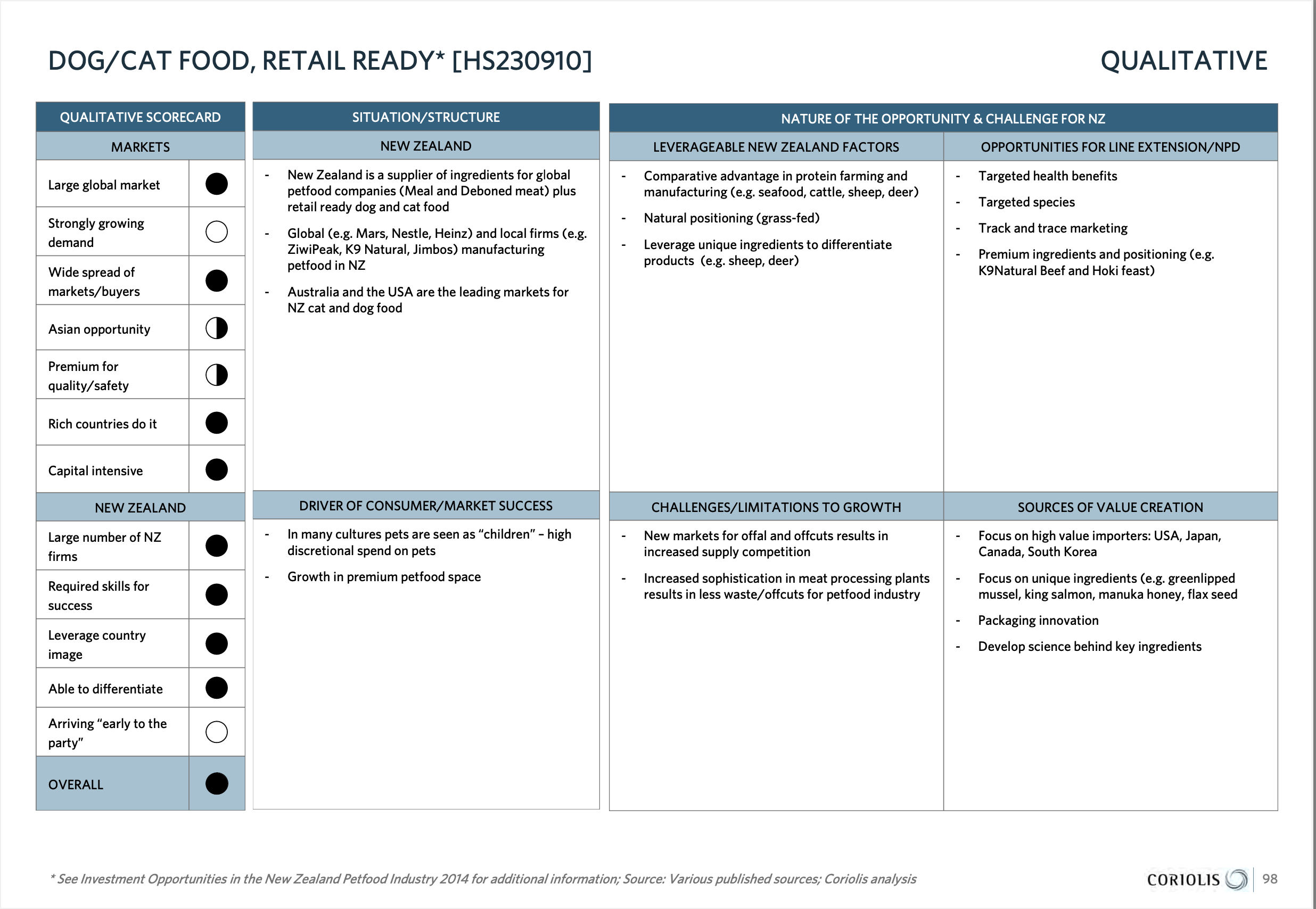

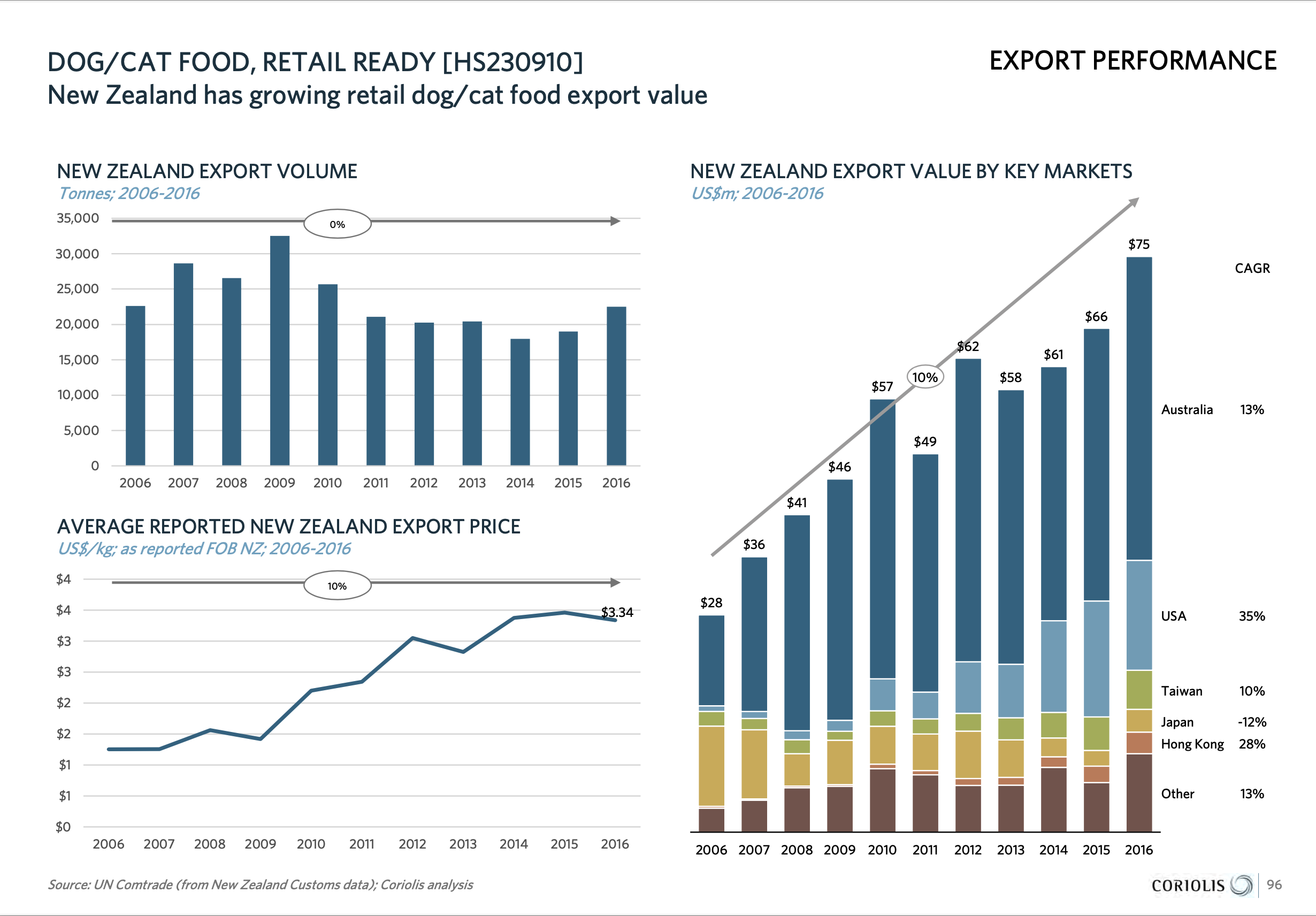

Retail pet food

Alcoholic spirits

Functional beverages

Identified new trends, investment gaps, and strategic pathways

Supported the vision of growing exports through diversified product development

First published in 2012 and updated in 2018, these reports became vital resources for investors, policymakers, and entrepreneurs looking to identify where the next wave of F&B innovation would come from.

2. Regional Growth Opportunities (RGO)

In 2019, Coriolis produced a national Regional Growth Opportunities and Outcomes series. This work:

Analysed F&B activity across all 15 New Zealand regions

Assessed each region’s unique assets, challenges, and sectoral strengths

Provided deep dives into specific regions, including:

Northland

Taranaki

These reports helped regional councils, iwi, and government agencies understand where and how to support agri-sector development locally.

3. Market Reports

To help New Zealand F&B firms and policymakers understand evolving international dynamics, Coriolis produced several strategic market-focused reports, including:

Dairy opportunities in Southeast Asia

F&B imports into Asia: uncovering gaps and trade opportunities

Beverage opportunities in Asia

Re-engaging with the UK market post-Brexit

These market intelligence reports were designed to de-risk export strategy and guide investment decisions, ensuring NZ remained globally competitive.

Emerging Growth Opportunities Series of reports

Markets reports

Regional Growth Opportunities reports

“When we look at investing in a new food sector and company, we also try and source the most recent Food and Beverage report.”

Output

The following resources were produced:

Twelve Emerging Growth Opportunities reports

Five Regional Growth Opportunities reports

Seven Market reports

These reports were then distributed to firms, potential investors across the sector, including those through international offices and made freely available for public use.

Outcomes

National Economic Impact

As previously detailed, during the iFAB project’s 11-year lifespan (2010–2021), New Zealand’s food and beverage sector:

Created 900 new firms

Added 32,000 new jobs

Grew industry turnover by NZ$16 billion (to NZ$54B)

Increased exports by NZ$14 billion (to NZ$41B)

Outperformed all other major sectors—keeping the economic ship afloat during a period of stagnation in other merchandise exports

Drives Investment Through Insight

The reports from Stream 2 played a crucial role in:

De-risking emerging categories for investors

Showcasing NZ’s comparative advantages

Providing high-quality information to investors, local entrepreneurs, iwi, and research agencies

Examples of Tangible Impact

Alcoholic Spirits

The 2014 report “Investment Opportunities in the New Zealand Spirits Industry” helped spark a surge in new distilleries. Interviews confirm that entrepreneurs used the report to validate business plans and secure backing, demonstrating the direct influence of the iFAB research.

Pet Food

The pet food category—profiled in detail in 2014 and again in later updates—has attracted over NZ$2 billion in investment. These reports were literally “on the table” during investment negotiations, showcasing their practical, deal-supporting value.

Conclusion

Stream 2 of the iFAB project extended the visibility and impact of New Zealand’s food and beverage industry far beyond its traditional strongholds. By focusing on what’s next—emerging categories, regional strengths, and international markets—Coriolis and its partners delivered a national economic development asset.

These reports remain core tools for investors, scientists, industry stakeholders, and government agencies, helping to guide the next decade of innovation and investment in New Zealand’s bioeconomy.

“Reading your report gave me the confidence to invest in a distiller and develop a brand.”

“The pet food report, in particular the updated one, provided great information we could take to the bank.”