CASE STUDY #3

Food and Beverage Information Project (iFAB)

Stream 1: Sector Reports and Investor Guides

Supporting investment and growth in NZ’s Food and Beverage sectors. A 10 year (2011-2021), all-of-government project.

Client

Problem

In 2006 the Food & Beverage Taskforce acknowledged that F&B data and information was fragmented and incomplete and identified the need for a comprehensive and consistent set of data and reports on the New Zealand F&B industries to support decision-making and investments.

Solution

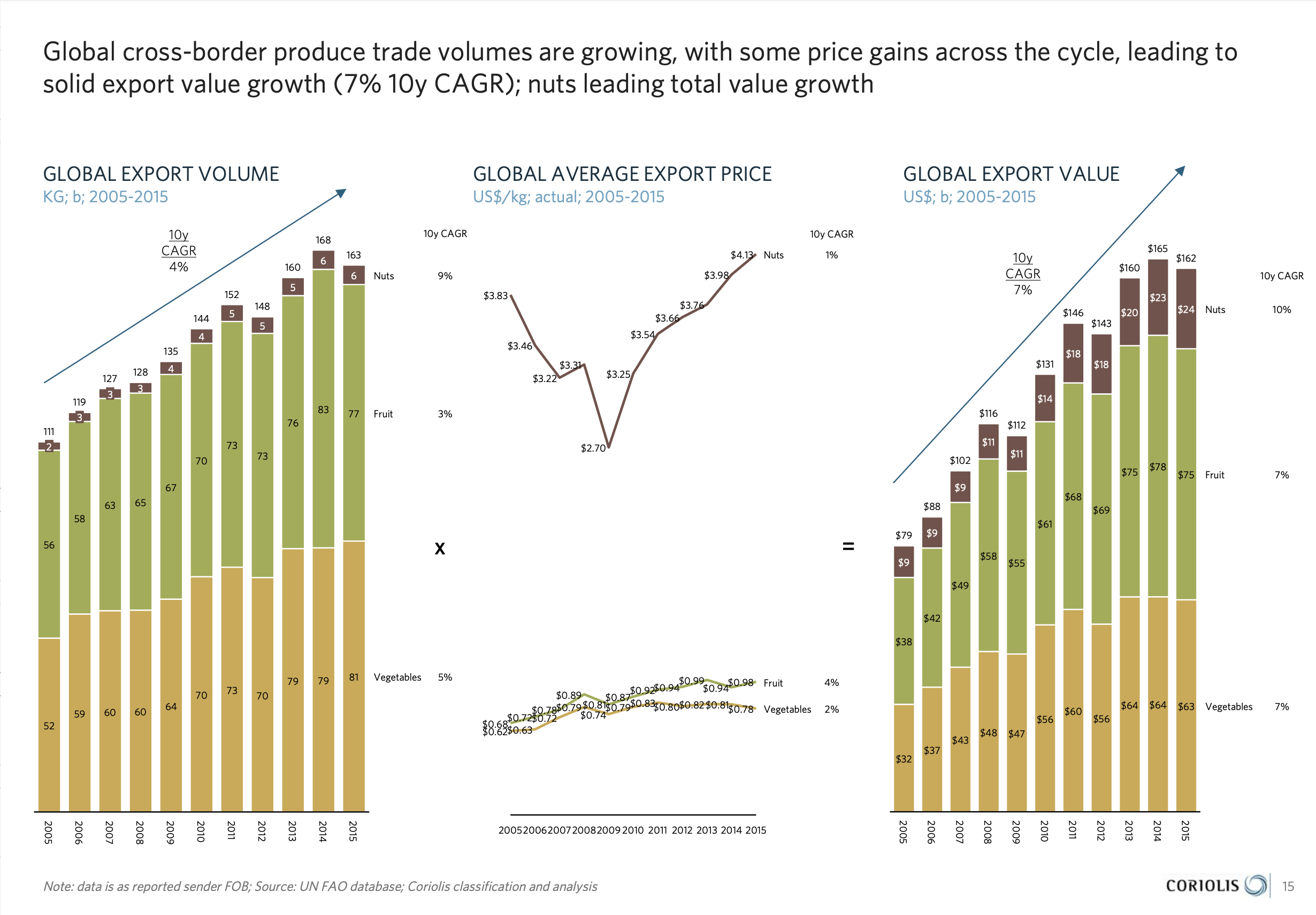

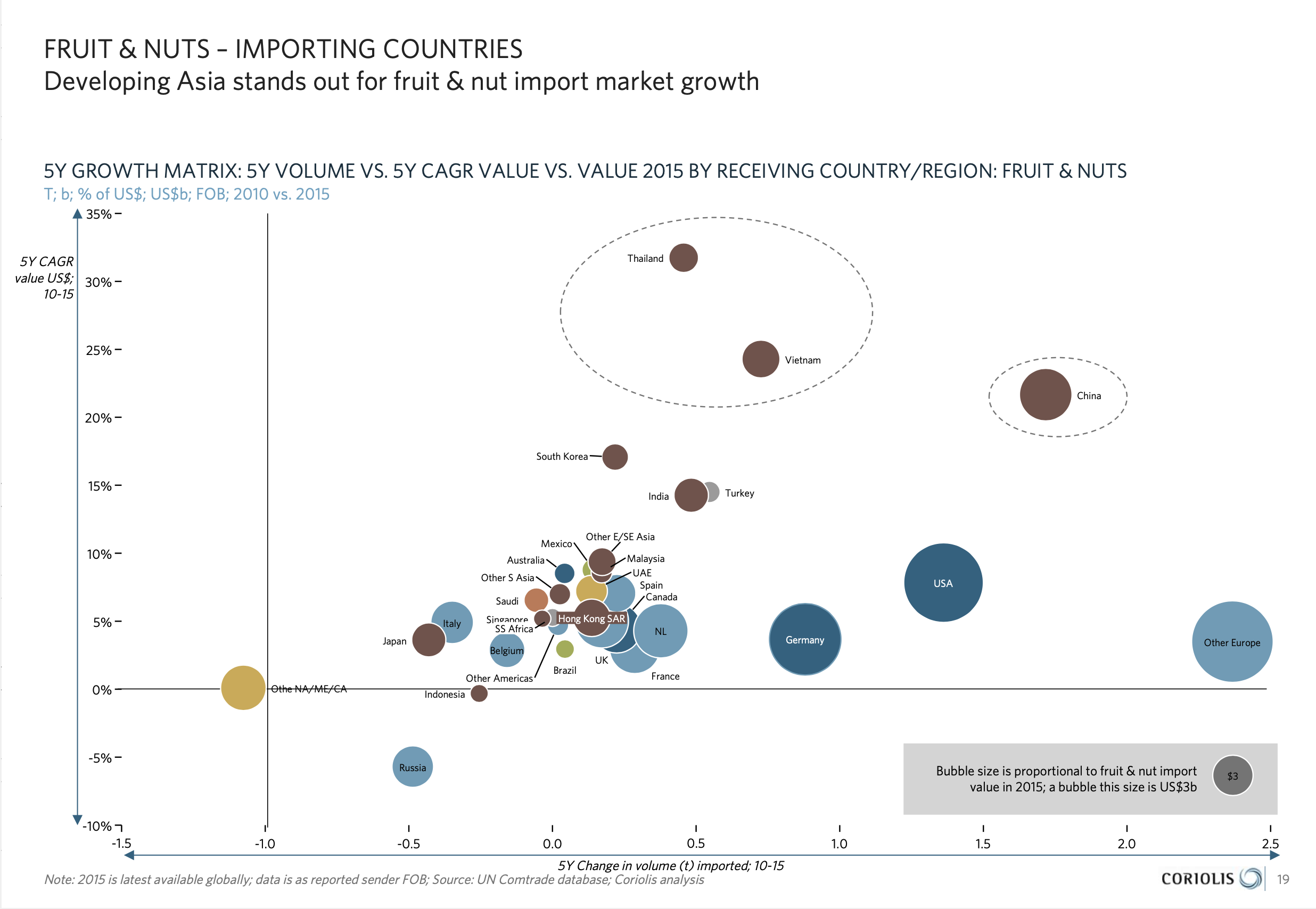

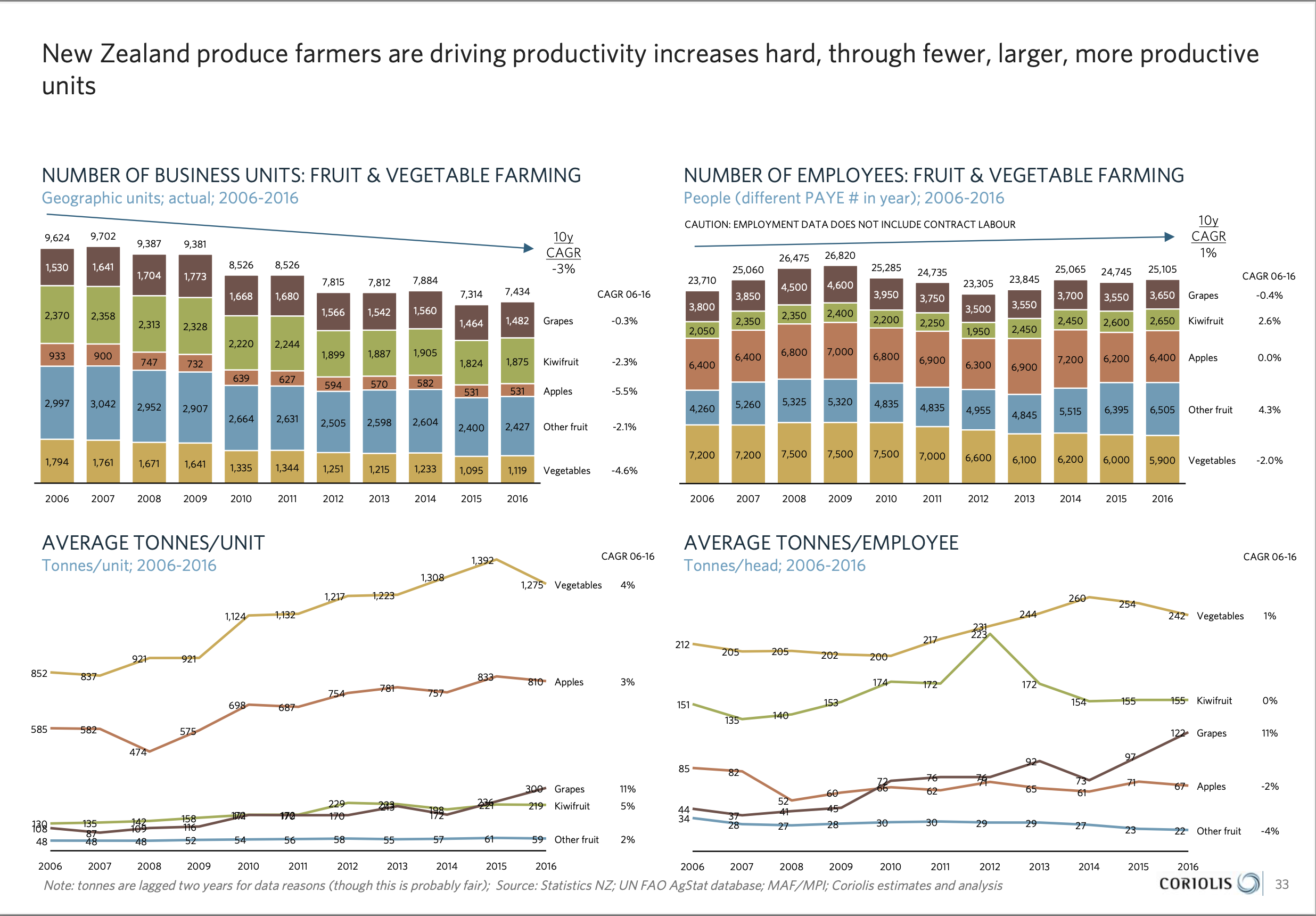

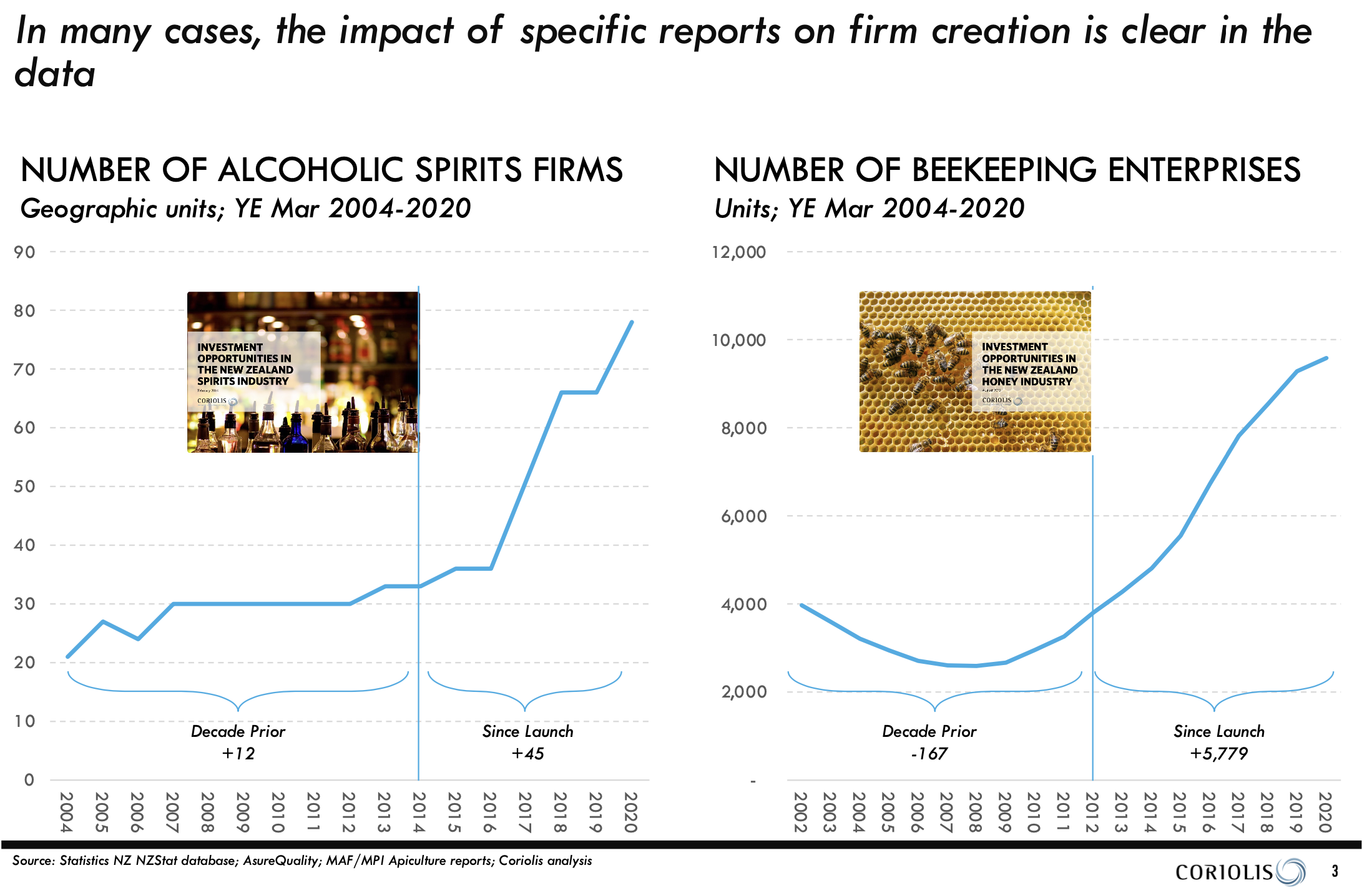

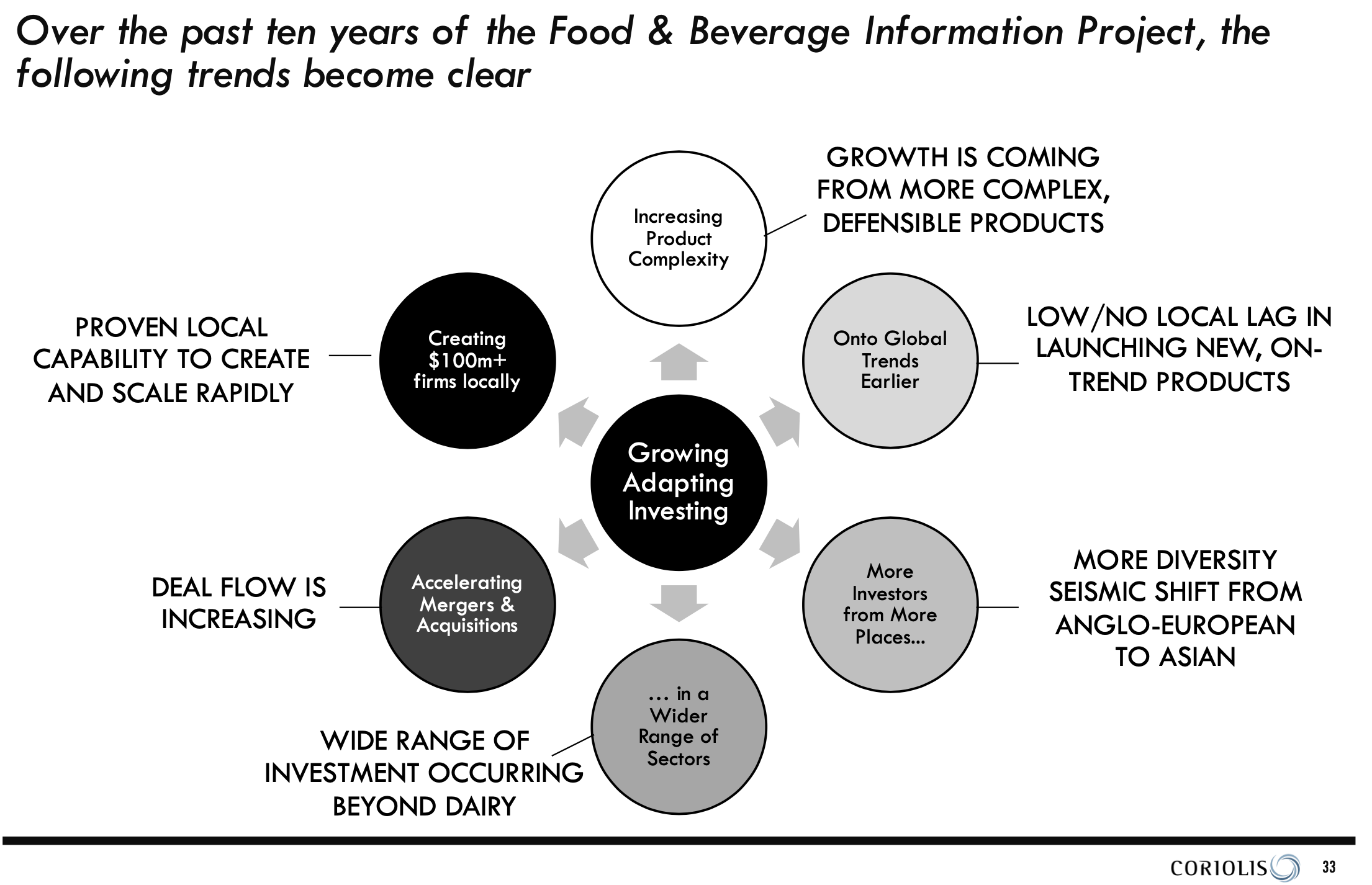

Coriolis proposed a solution that provided a comprehensive and consistent set of data-driven reports on the current and evolving state of New Zealand’s food and beverage sector. These reports provide an analysis of the structure and dynamics of the industry, market trends, information on future opportunities and threats, and peer country comparisons, a who’s who of firms and investments. They are freely available for use by investors, industry participants, government and researchers.

What we did

A total of fifty-three reports were written over the 10 years of this project.

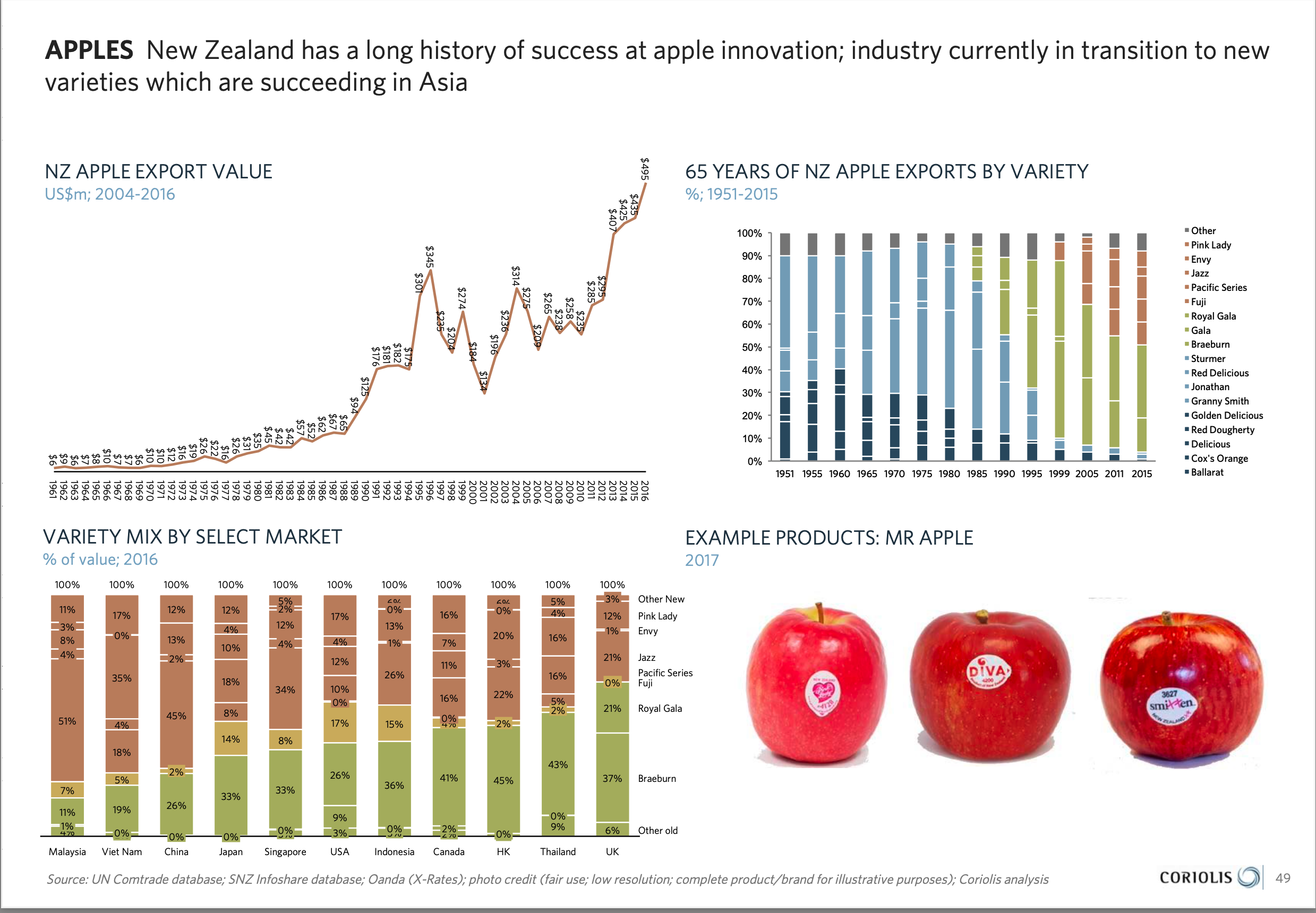

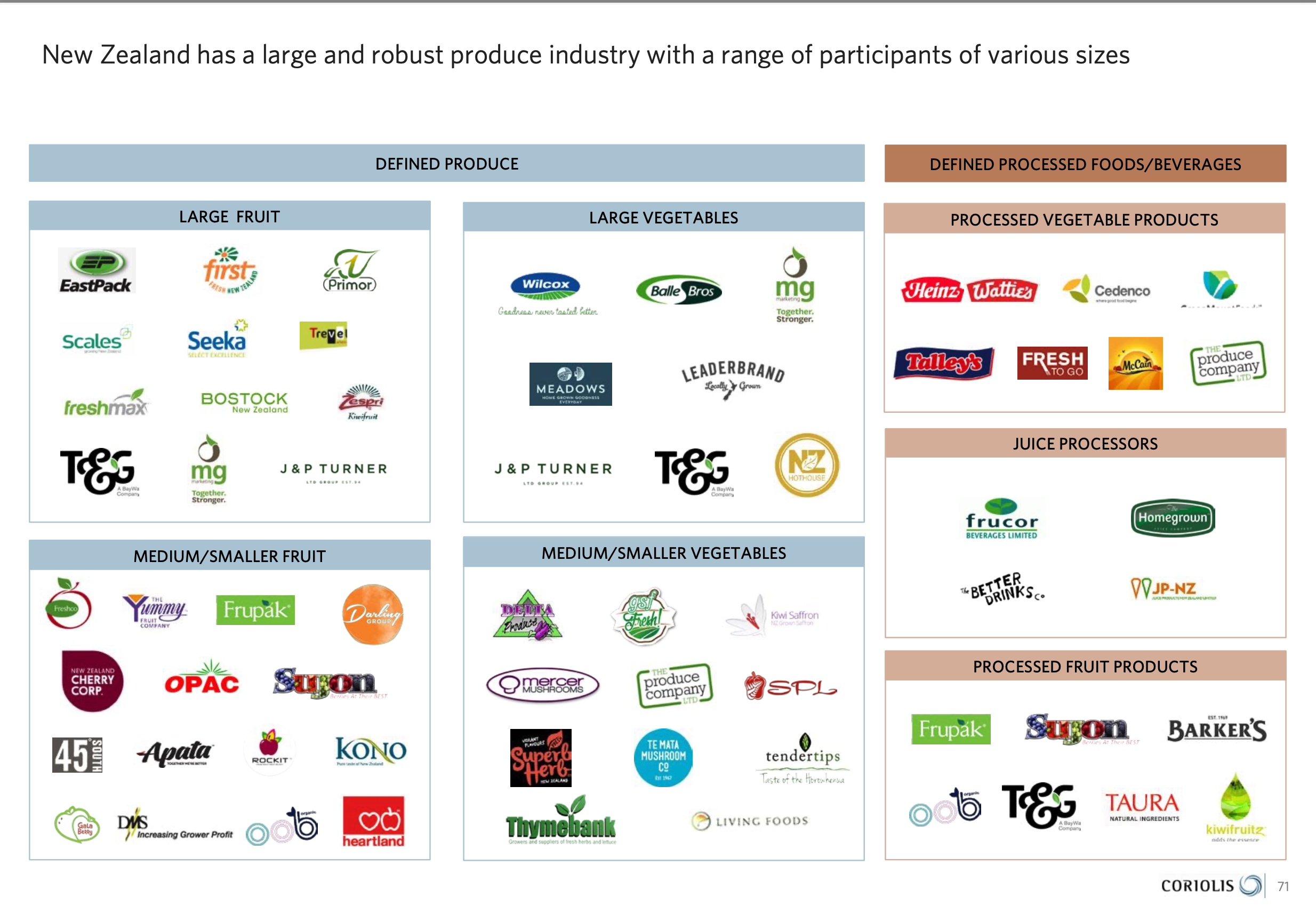

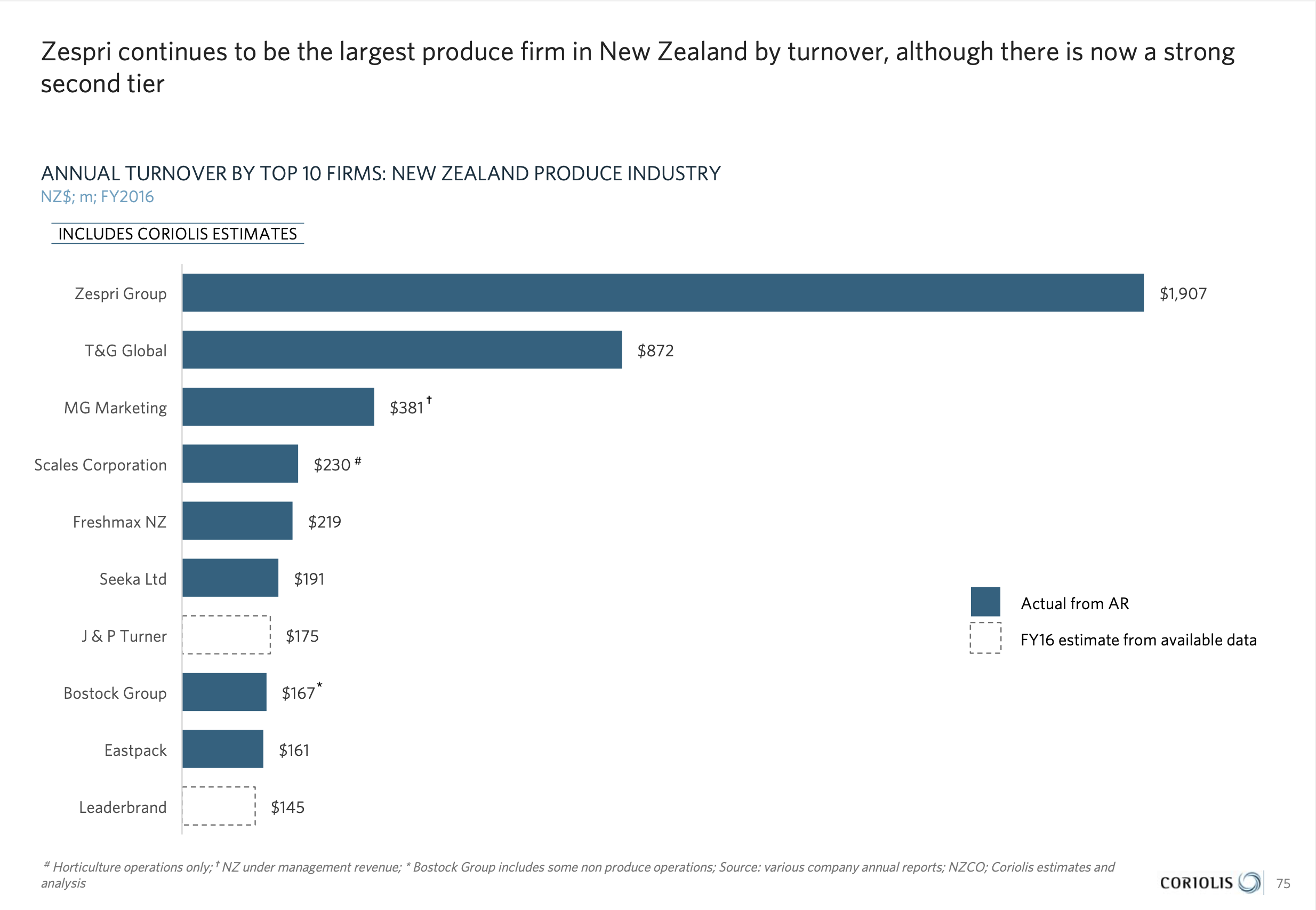

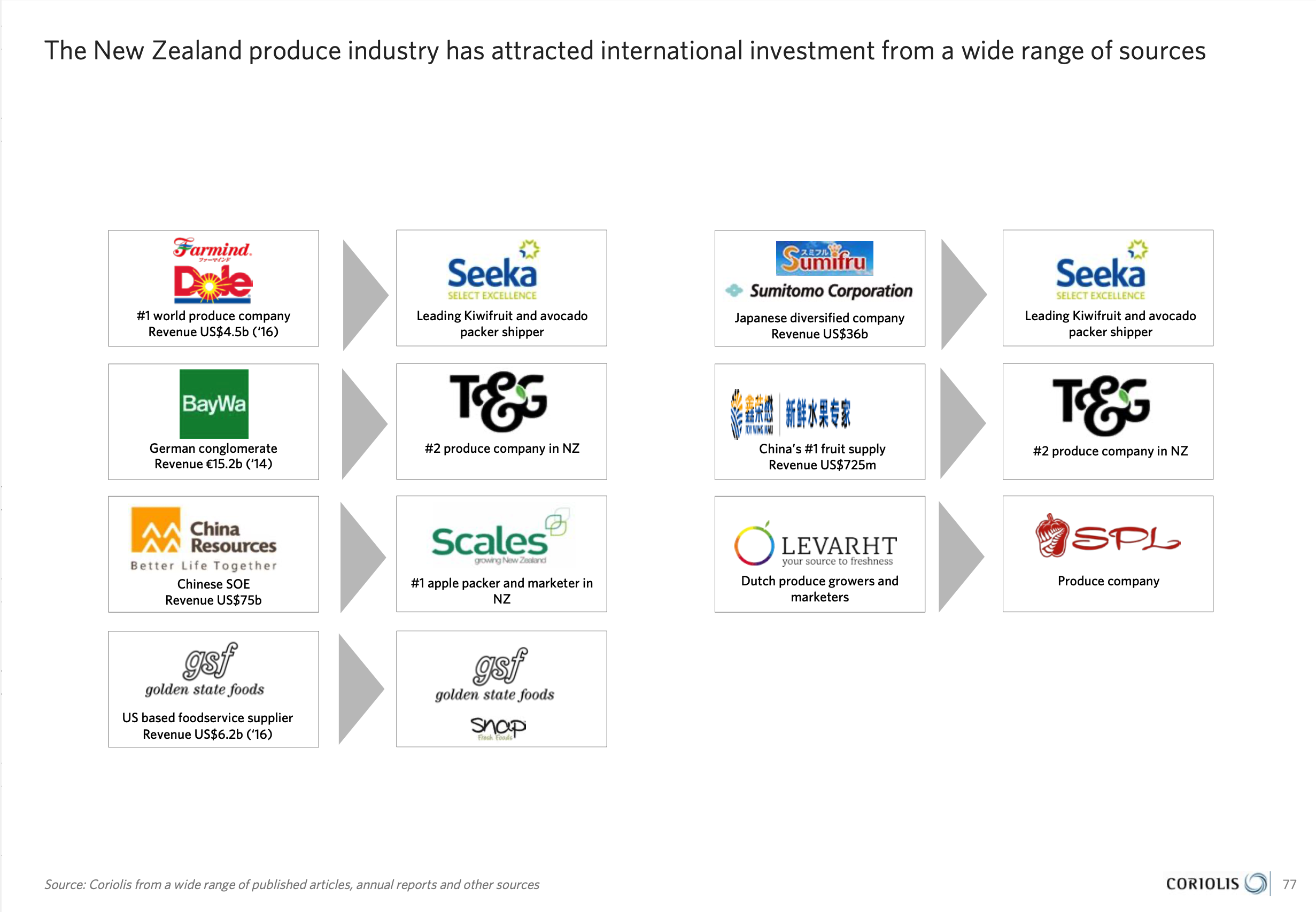

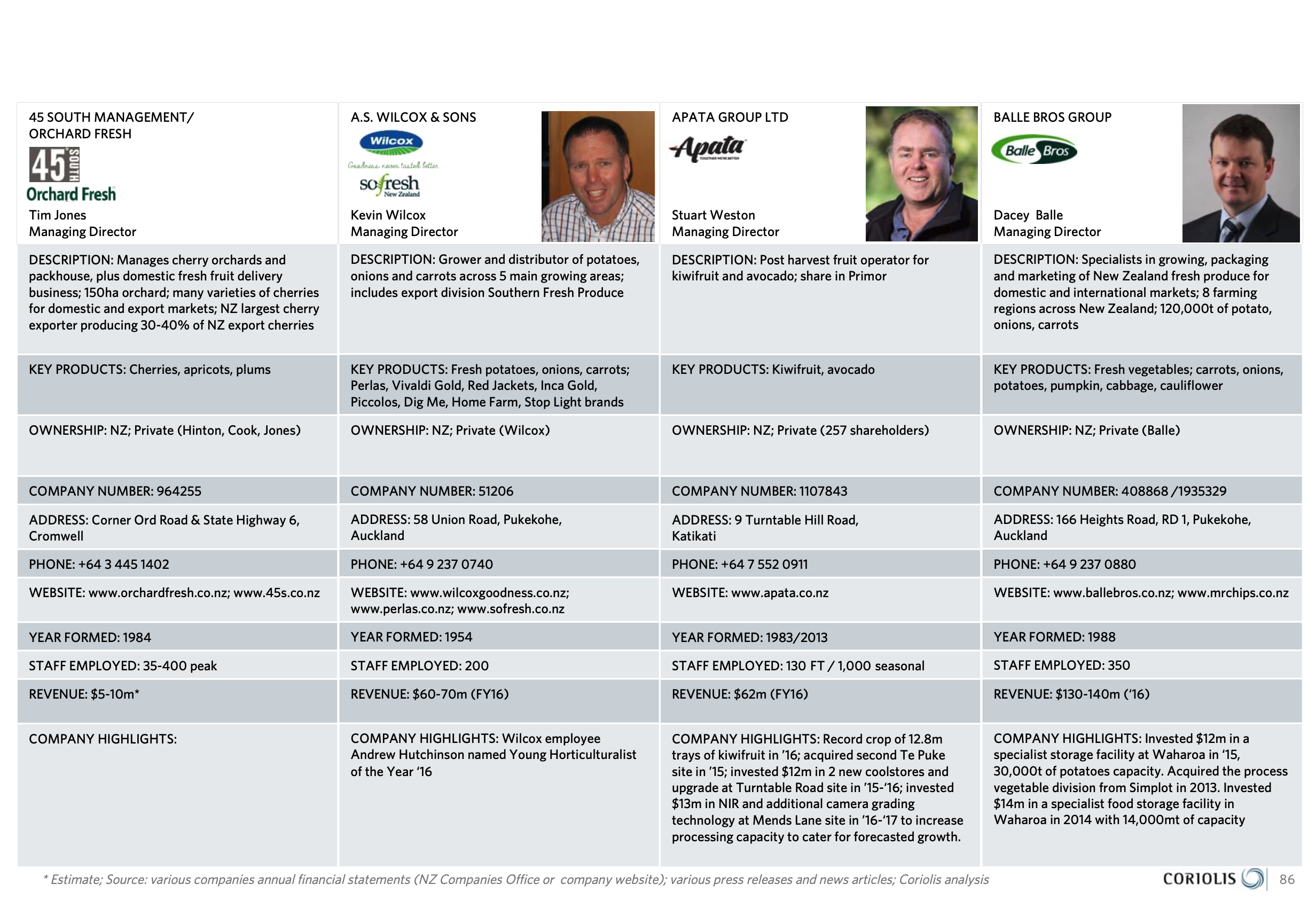

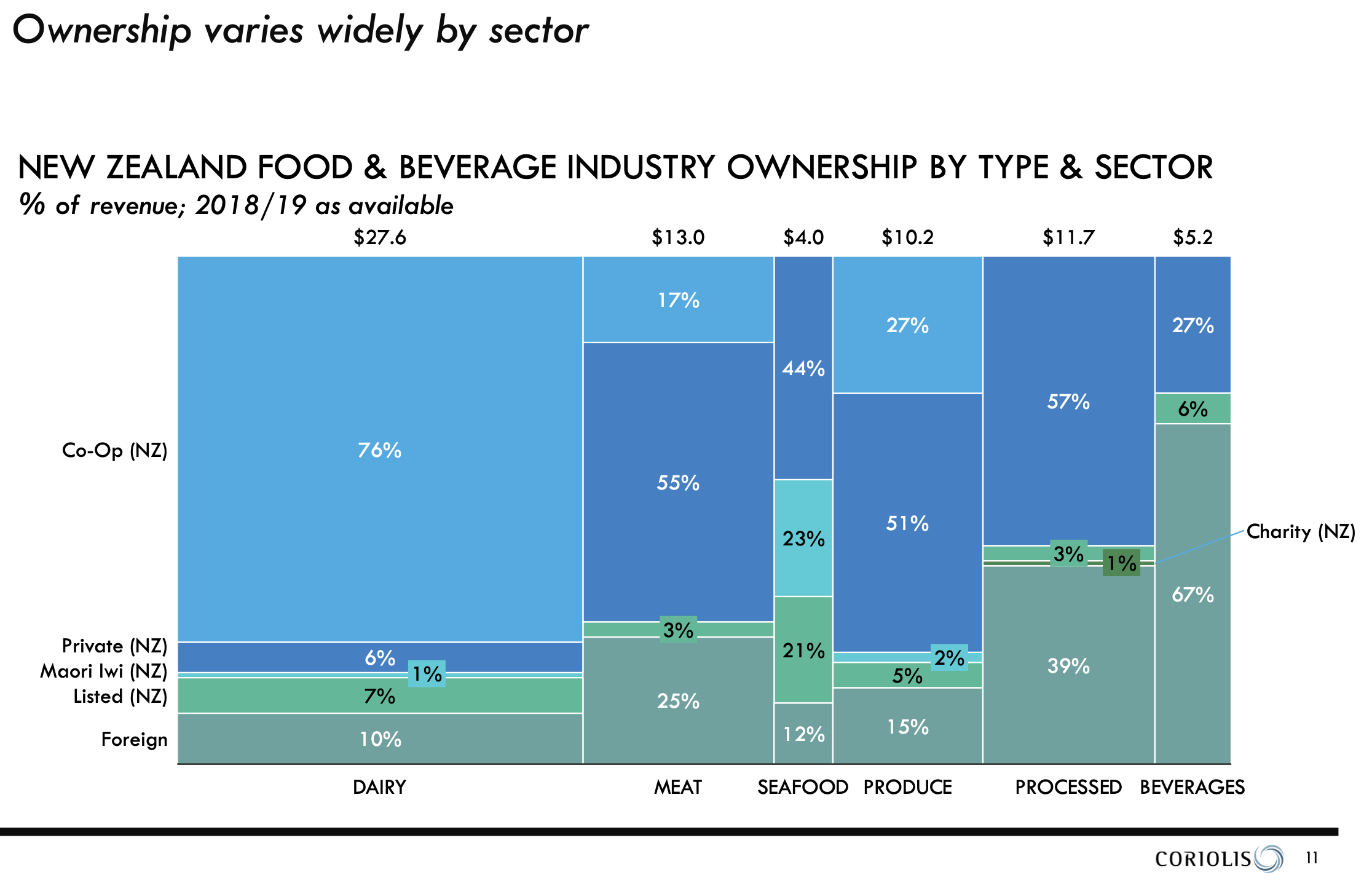

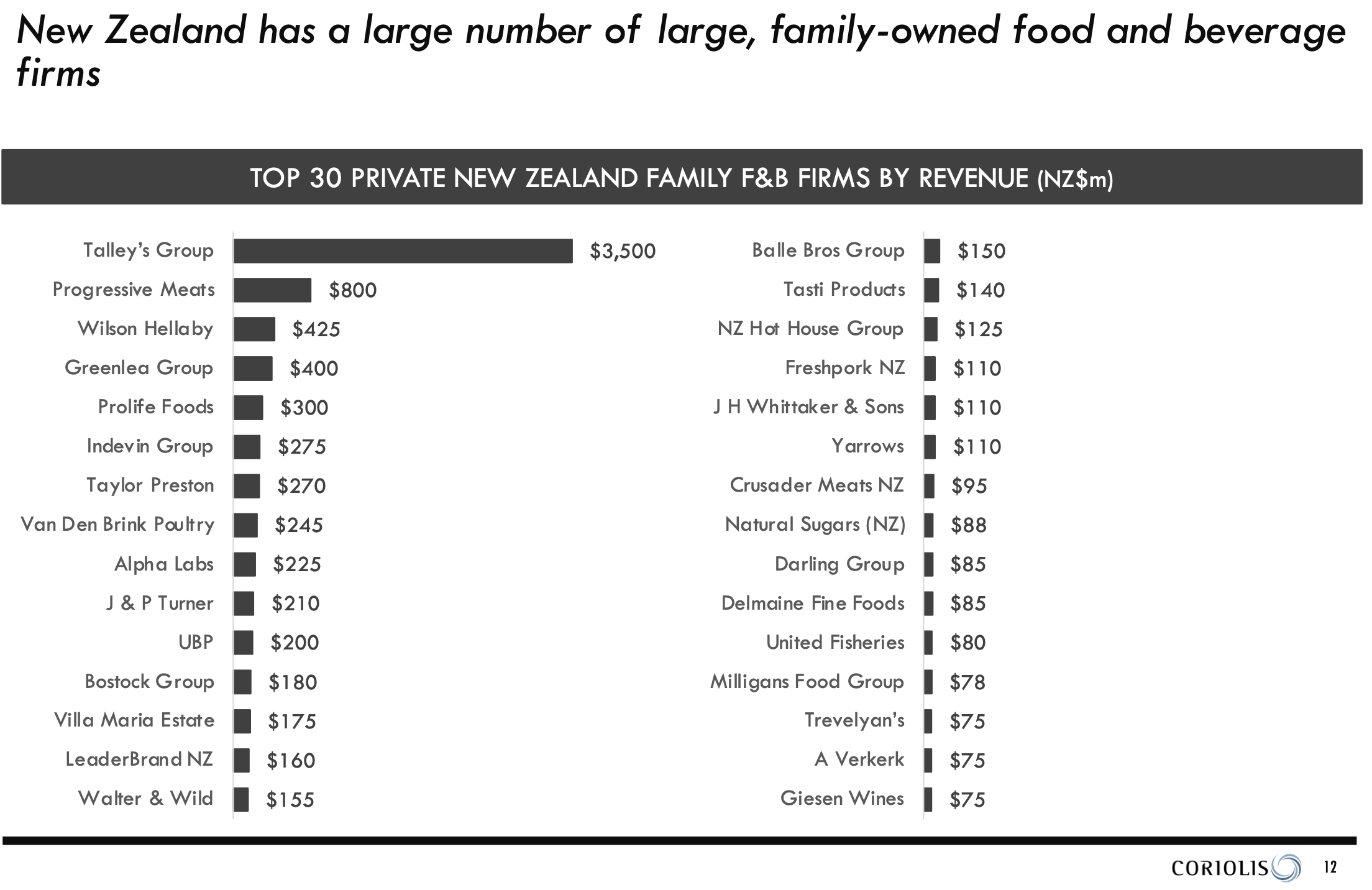

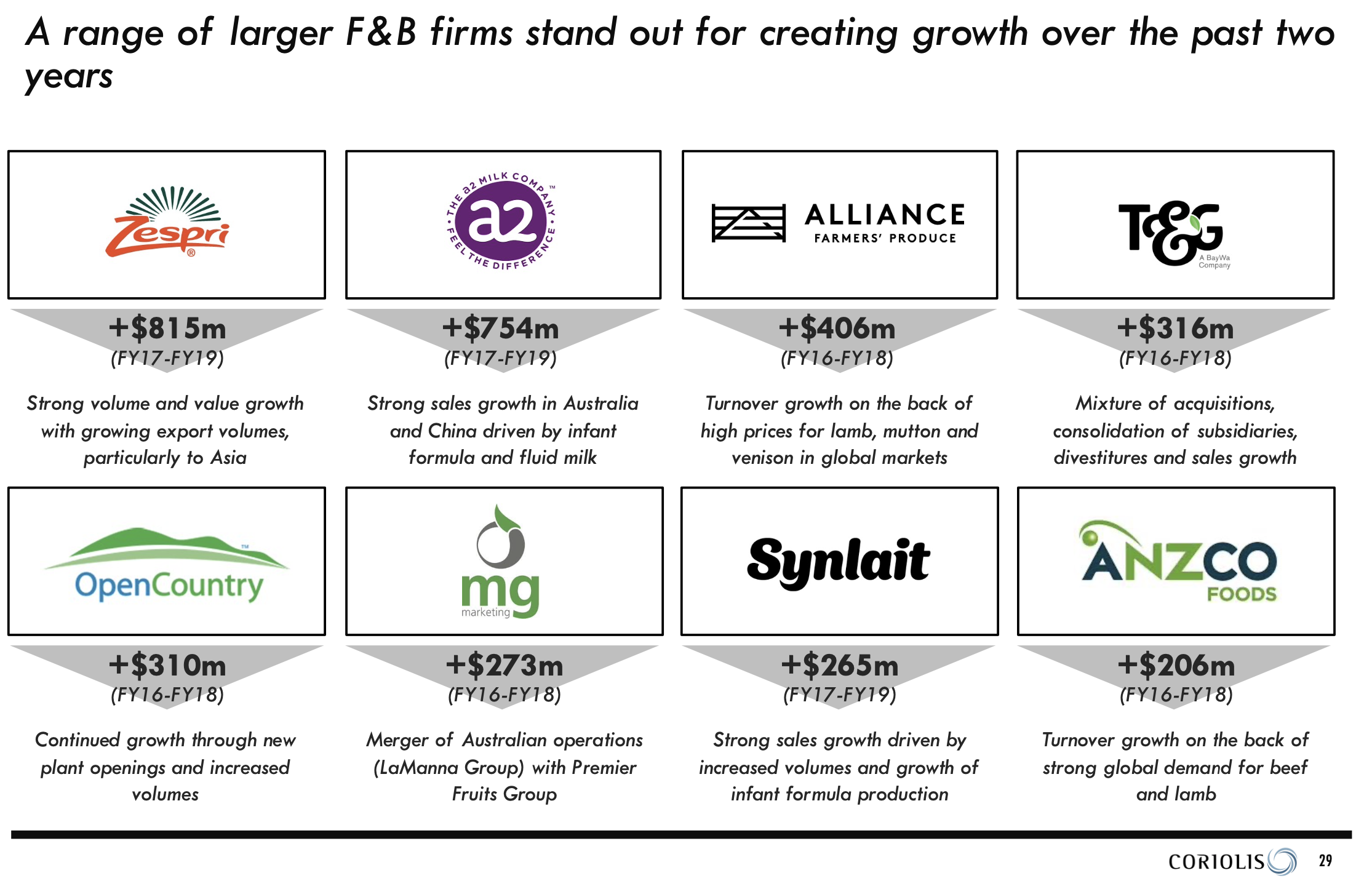

Stream 1: Sector Reports cover six core sectors: Dairy, Meat, Produce, Seafood, Processed Foods and Beverages. Each sector report contained Investment opportunities, a Global market summary, New Zealand production analysis, Segment data (export data and share), Growth and innovation analysis, Firm analysis, (including investments and acquisitions and major firm profiles). The Overview reports summarised the entire industry.

Also in Stream 1 are the Investor Guides that provide a compelling narrative supporting further investment in the sector.

Regular updates of the reports provided ongoing tracking of sector growth, investment and company activities.

Regular deep dives were also produced on the sectors e.g. Fresh fruit, Nutraceuticals, Seafood, Processed Foods

Investors Guides

Sector Reports

Output

The output from Stream 1 was:

Twenty two sector reports (including sector depths), plus

Seven Investor Guides and Overview Reports

These reports were then distributed to firms and potential investors across the sector, including those through international offices.

Outcomes

Results

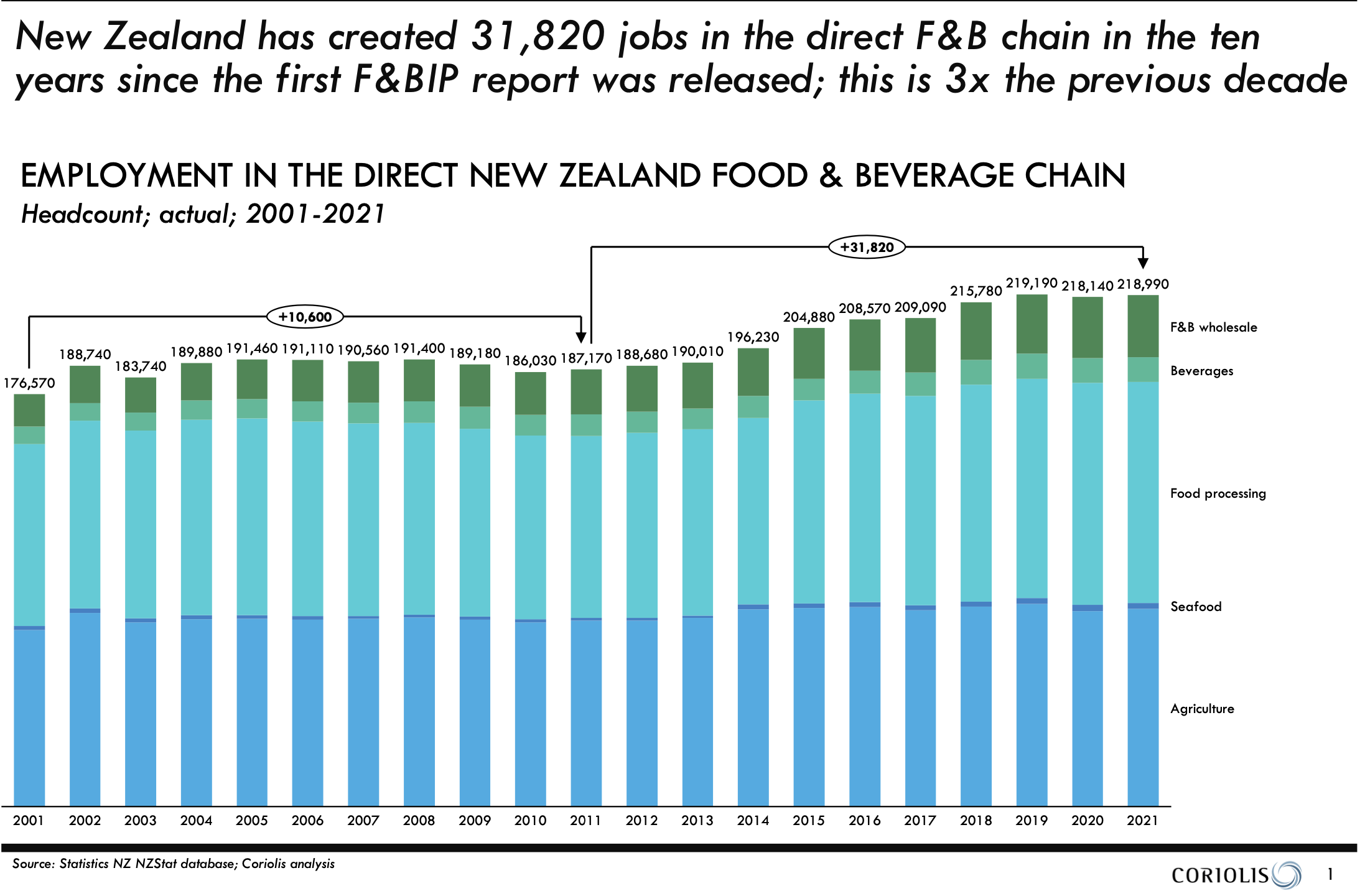

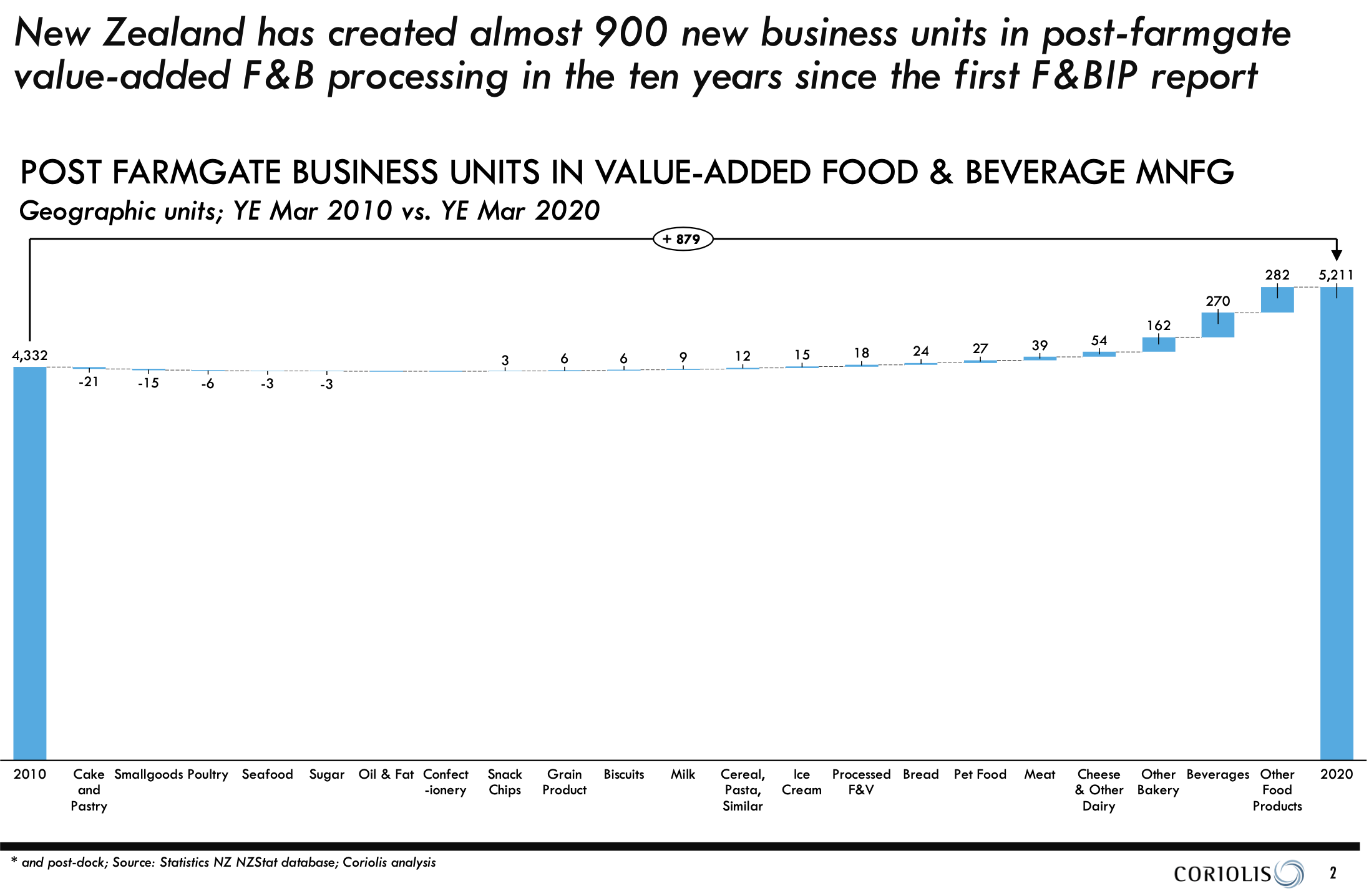

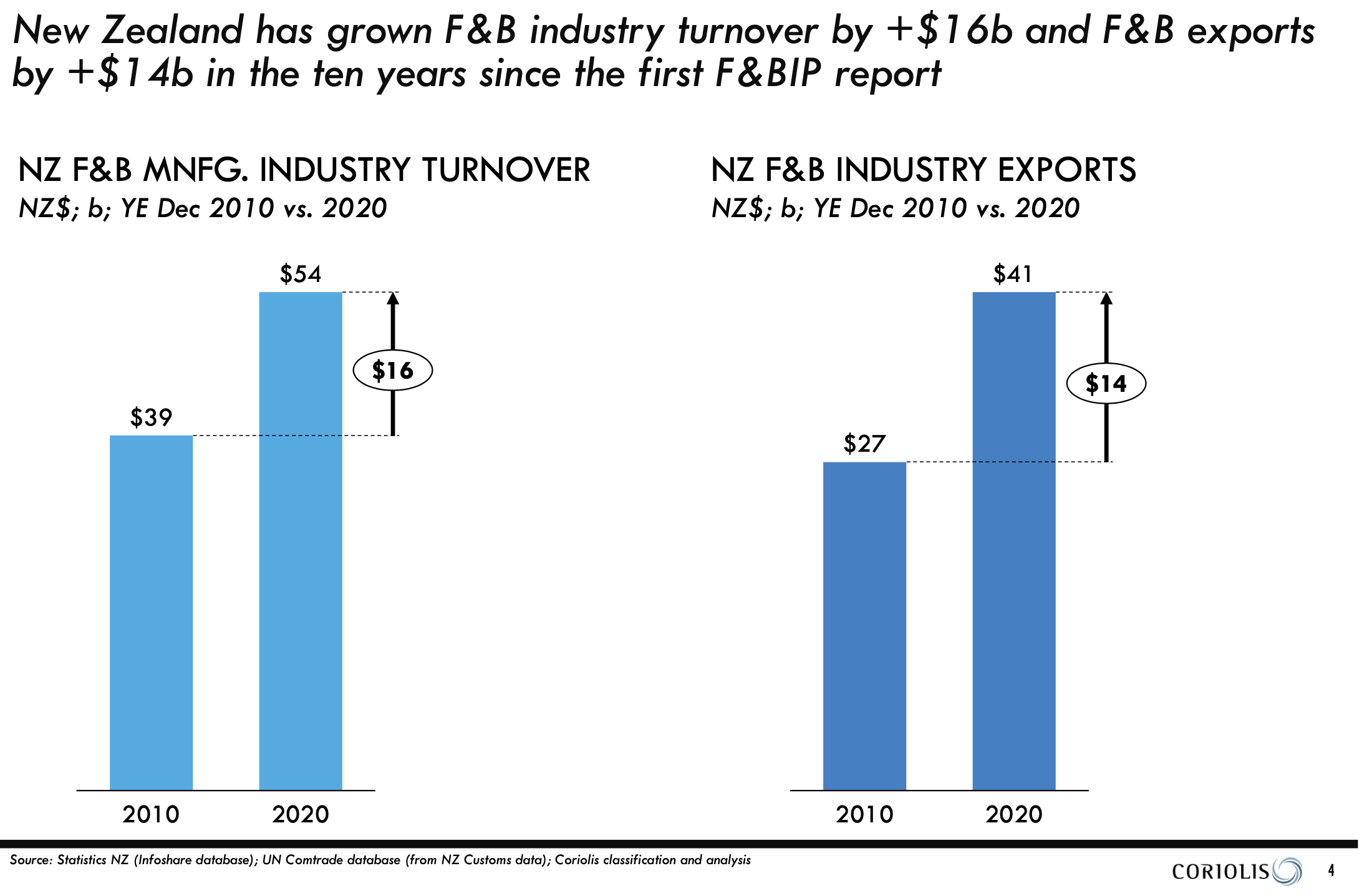

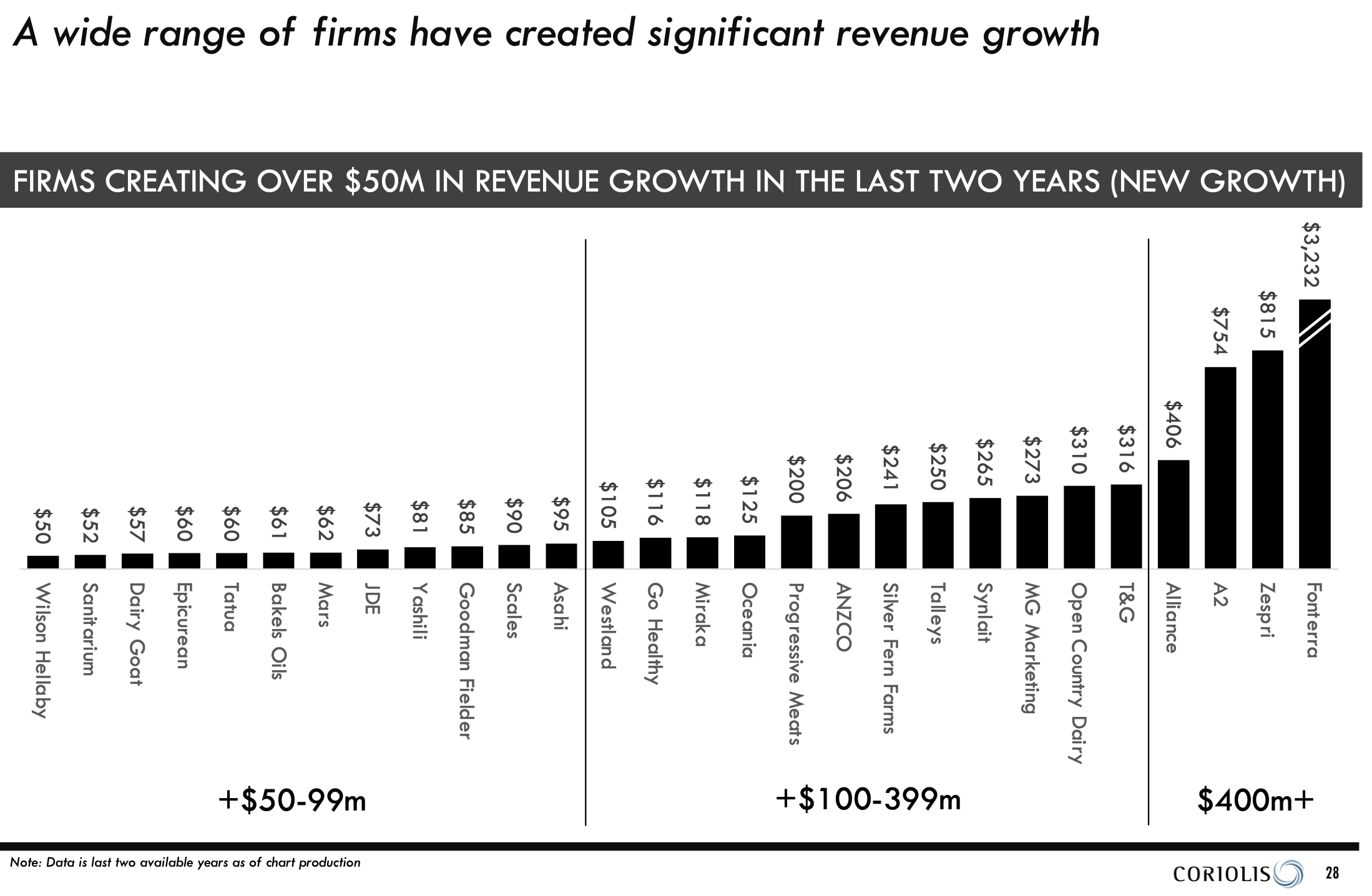

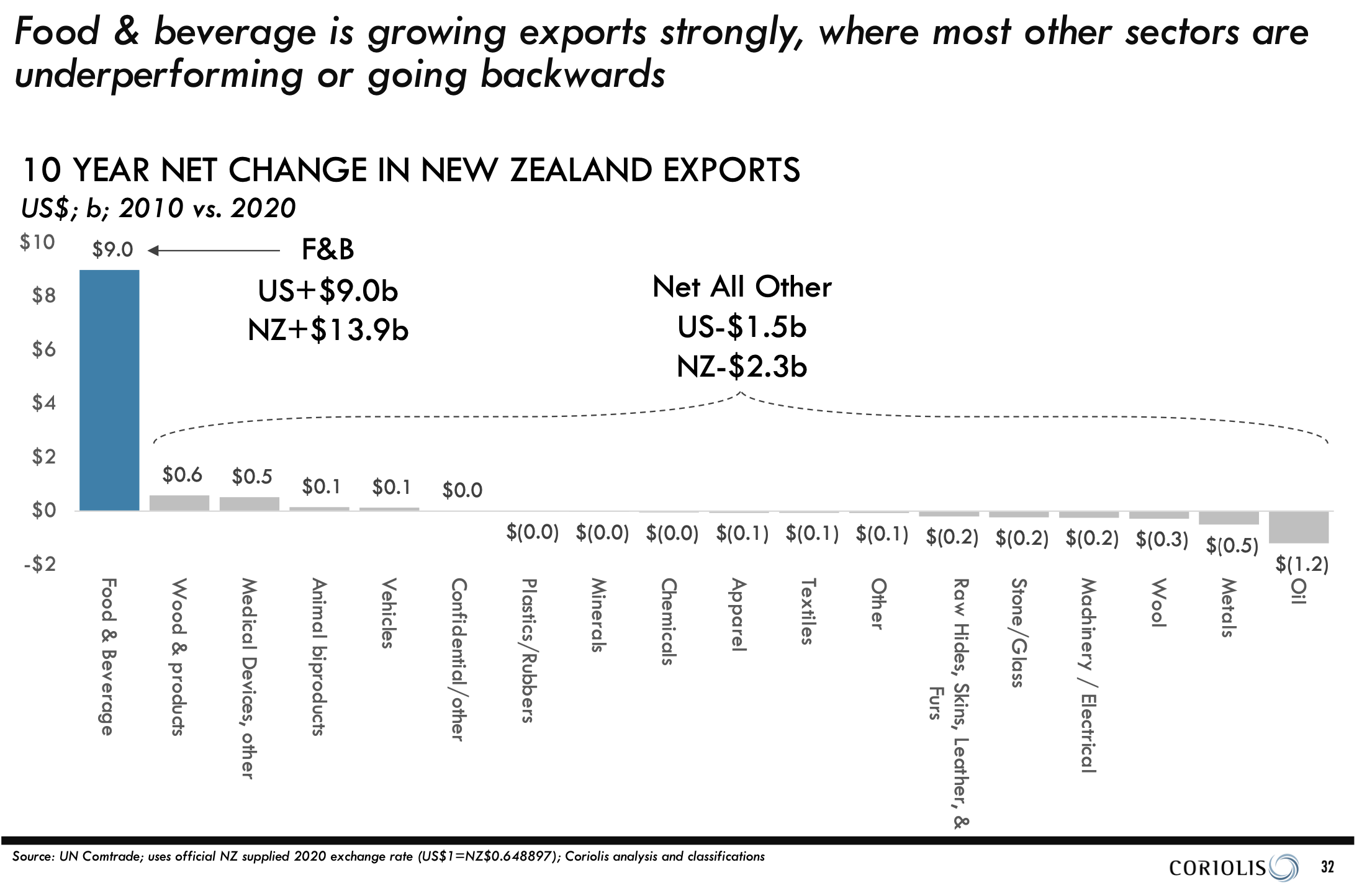

In the 11 years of the Project's existence, the New Zealand food and beverage industry was the major engine of export growth for New Zealand. Over this period, the industry created almost 900 net new firms, generated almost 32,000 net new jobs, increased food and beverage manufacturing industry turnover by NZ$16 billion (to $54 billion in 2020), and boosted exports by $14 billion (to $41 billion in 2020). To achieve this, it needed to attract at least NZ$14 billion in investment. The industry delivered results for New Zealanders. Over the same period (2010 to 2020), the net value of all other merchandise trade exports shrank by $2 billion. Food and beverage was the only major sector that "kept the economic ship afloat."

Drives Investment

The project drives investment by mitigating sectoral risk, providing in-depth insights into the growing, innovative, and competent New Zealand food and beverage sector. The reports showcase the country's strong comparative advantages, positioning it as a serious contender for investment. This allows investors to focus on specific businesses, reducing overall risk and uncertainty. The comprehensive reports, notably the "Investor's Guides,” reinforce New Zealand's appeal, attracting diverse investors and dispelling outdated perceptions, ultimately making a compelling case for investment in the thriving industry.

“A feeling of serenity comes over me, when I open one of your reports.”

“In a small way, the research helped keep interest rates down. It resulted in more confidence and less risky lending.”